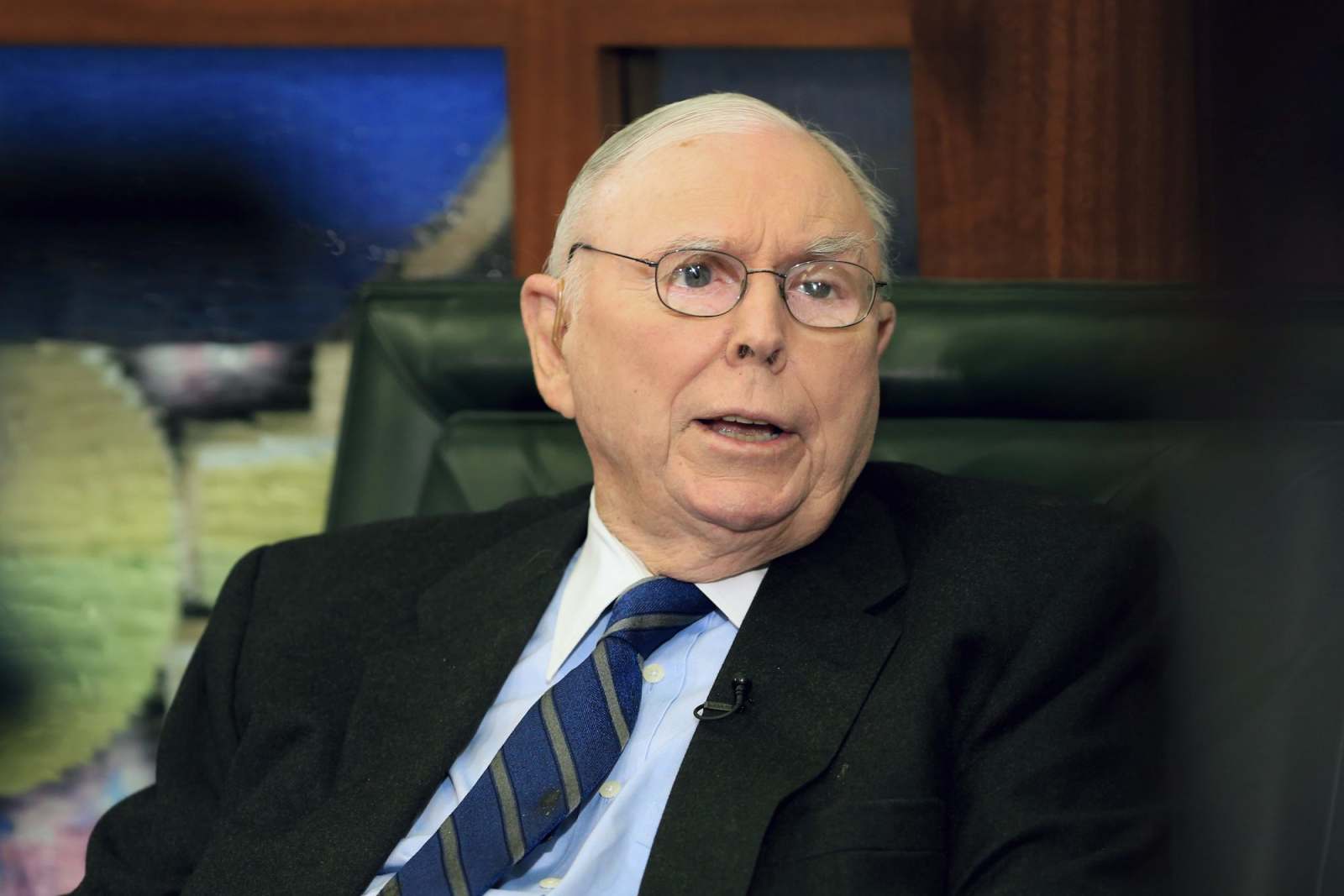

Investment legend Charlie Munger says the current climate on global markets is crazier than the dot-com bubble two decades ago, as he savaged the boom in cryptocurrencies as insane and backed China’s ban on the digital assets.

The 97-year-old vice chairman of Warren Buffett’s Berkshire Hathaway also said Australia should try to help calm tensions between China and the United States, as he predicted the two superpowers would avoid a war and reach an “acceptable relationship.”

Addressing Australian investors at the Sohn Hearts and Minds conference on Friday, Mr Munger underlined the stretched valuations of quality listed companies, and reiterated his extreme scepticism towards cryptocurrencies such as Bitcoin.

Mr Munger, Mr Buffet’s right-hand man, said the investment environment was “a little more extreme” than what he had seen in his decades of experience, and he backed China’s attempts to clamp down on “some of the exuberances” of capitalism.

“I think the dot com boom was crazier in terms of valuations than even what we have now. But overall, I consider this era even crazier than the dot-com era,” Mr Munger said.

In a wide-ranging discussion with Dr Mark Nelson of hedge fund Caledonia, Mr Munger said he would not participate in an “insane” cryptocurrency boom, and was scathing of promoters of crypto assets.

“I’m never going to buy a cryptocurrency. I wish they’d never been invented,” he said.

“I think the Chinese made the correct decision, which is to simply ban them. My country - English-speaking civilisation - has made the wrong decision,” he said.

“I just can’t stand participating in these insane booms, one way or the other. It seems to be working; everybody wants to pile in, and I have a different attitude. I want to make my money by selling people things that are good for them, not things that are bad for them,” he said.

“Believe me, the people who are creating cryptocurrencies are not thinking about the customer, they are thinking about themselves.”

On China, where Berkshire has major investments including in car manufacturer BYD, Mr Munger was positive, highlighting its long-term growth, though he added almost every capitalist was less enthusiastic about China than they were a year ago. As well as supporting China’s crypto ban, Mr Munger said the regime was right to clamp down on booms.

“I think they were right to cut back on some of the exuberances that come... with capitalism,” Mr Munger said.

As for the volatile relationship between the US and China, he predicted the two countries could reach an “acceptable relationship,” and Australia could play a role calming tensions through its ties with both countries.

“I think Australia, with its deep involvement in China, can be in a constructive position. Australia can encourage both the United States and China to be more reasonable,” Mr Munger said.

Mr Munger and Mr Buffet are famous “value” investors, an approach based on buying stocks with strong long-term prospects that the market appears to have undervalued. However, Mr Munger said the high level of share prices made this approach much harder.

“Of course it’s possible, but you have pay a great deal more for the good companies now,” he said.

On specific companies, Mr Munger said he was a big fan of Costco, which he said was a highly efficient retailer that he predicted could eventually be a fierce competitor to online retail giant Amazon.

Mr Munger also said he was a strong supporter of using more renewable energy instead of burning fossil fuels.

“I would be in favour of using a lot more renewable energy from wind and solar, even if there were no global warming problem.”

“I love the fact that we’re rapidly reducing the burning of coal and the burning of gasoline and diesel…and replacing them with electricity from renewable sources,” he said.

This article was originally posted by The Age here.

Licensed by Copyright Agency. You must not copy this work without permission.